by admin | Apr 12, 2016 | Recent Works

Elegant Inc. Architects

Cu omnium propriae mel. Eum detracto suscipit ut, et vix splendide scriptorem. His exerci integre moderatius et, ea vis zril choro deseruisse. Ea qui omnesque mnesarchum liberavisse. Ei mei unum lorem, te nam velit philosophia et vix splendide ispum.

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed quia consequuntur magni dolores eos qui ratione voluptatem sequi nesciunt. Neque porro quisquam est, qui dolorem

aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab

At vero eos et accusamus et iusto odio dignissimos ducimus qui blanditiis praesentium voluptatum deleniti atque corrupti quos dolores

Urban & Commercial Design

Cu omnium propriae mel. Eum detracto suscipit ut, et vix splendide scriptorem. His exerci integre moderatius et, ea vis zril choro deseruisse. Ea qui omnesque mnesarchum liberavisse. Ei mei unum lorem, te nam velit philosophia. Ea qui omnesque mnesarchum liberavisse. Ei mei unum lorem, te nam velit philosophia

Cu omnium propriae mel. Eum detracto suscipit ut, et vix splendide scriptorem. His exerci integre moderatius et, ea vis zril choro deseruisse.

Interior Spaces & Experiences

Cu omnium propriae mel. Eum detracto suscipit ut, et vix splendide scriptorem. His exerci integre moderatius et, ea vis zril choro deseruisse. Ea qui omnesque mnesarchum liberavisse. Ei mei unum lorem, te nam velit philosophia

“At vero eos et accusamus et iusto odio dignissimos ducimus qui blanditiis praesentium voluptatum deleniti atque corrupti quos dolores et quas molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia deserunt mollitia animi”

“At vero eos et accusamus et iusto odio dignissimos ducimus qui blanditiis praesentium voluptatum deleniti atque corrupti quos dolores et quas molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia deserunt mollitia animi”

“At vero eos et accusamus et iusto odio dignissimos ducimus qui blanditiis praesentium voluptatum deleniti atque corrupti quos dolores et quas molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia deserunt mollitia animi”

Let’s Build Something

Cu omnium propriae mel. Eum detracto suscipit ut, et vix splendide scriptorem. His exerci integre moderatius

contact@diviarchitact

1234 Divi St., San Francisco, CA

+1 (111) 222-4455

by admin | Apr 11, 2016 | Recent Works

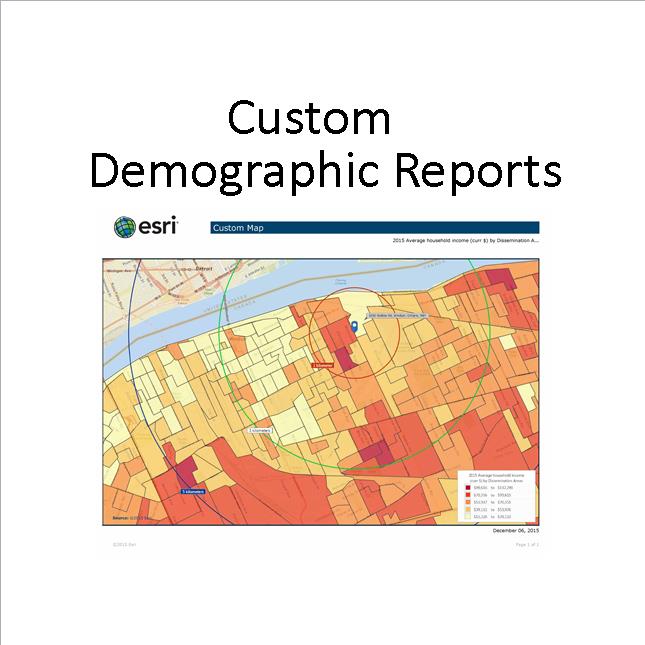

A demographic report prepared by a Certified Commercial Investment Manager CCIM is different from a typical residential demographic report. CCIM member have access to the CCIM Site To Do Business STDB. The STDB offers several different types of reports and map funcions. CCIM Demographic Market Reports have market information and spending habits as well as the unique ability to create visual reports on maps using demographic data. The market demographic report is very helpful as it indicates how much spending is occuring in an area, this can be very helpful when determining if a location is right for you. Reports can sort data based on Age, Sex, Occupation, Income, Family, Housing, Language and Ethnicity. A comparison can also be made of 2 locations to show which location has more favorable demand for a business. When you combine this with traffic counts and local knowledge of the area, a business can make a much nore educated decision on a potential location.

by admin | Apr 10, 2016 | Recent Works

Cameron Paine became a member of the Canadian Commercial Council of Realtors in 1996. Members of the Canadian Commercial Council of Realtors are experienced in commercial real estate.

The Canadian Commercial Council of Realtors ensure that members have specialized knowledge in one or more areas of commercial real estate, namely; appraisal, office leasing, industrial leasing/sales, multi-family/apartment buildings, property management, land/development sites, syndication, investment, retail leasing/business brokerage, consulting, farms/ranches, hotels/motels;

Qualifications to become a member include:

A commercial real estate course, which has been approved by the Council.

Knowledge of the following: • Leasing • Investment Analysis • Commercial Financial Calculator • Commercial Construction • Business Brokerage • Taxation/Financing • Planning and Zoning Examples of acceptable courses include: • CCIM courses •

Experience in: SALES/LEASING: Has within the last two years completed a minimum of three (3) commercial transactions or a volume of two million dollars ($2,000,000).

OR

Experience in PROPERTY MANAGEMENT: Must have five million dollars ($5,000,000) of real estate under management.

OR

Experience in APPRAISAL: Must have a minimum of six (6) appraisals of industrial, commercial and/or income producing properties within immediate past year, exceeding the value of two hundred and fifty thousand dollars ($250,000) each and having a minimum aggregate value of two million dollars ($2,000,000). OR A combination of the above

Cameron has been involved in over 75 million in Commercial Rela Estate Trensactions. Cameron also manages a large Commerical real estate portfolio, and has represented such larger clients as the City of Windsor, Ontario Realty Corp, Her Majesty the Queen, County of Essex, Enwin Utilities, Greater Essex County Public School Board, Greater Essex County Catholic School Board, Town of Lakeshore, RIO CAN, TD Bank, Royal Bank, Smart REIT, Canadian REIT, Amico and may others.

by admin | Feb 15, 2013 | Market Watch, Recent Works

RESIDENTIAL MARKET

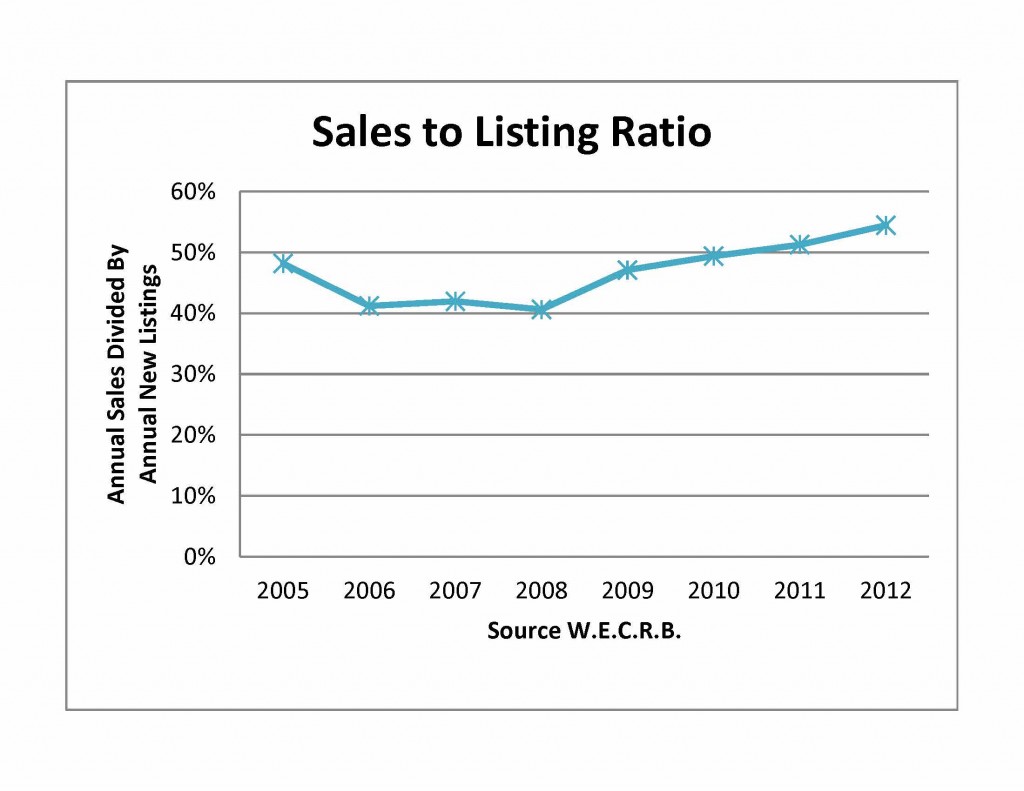

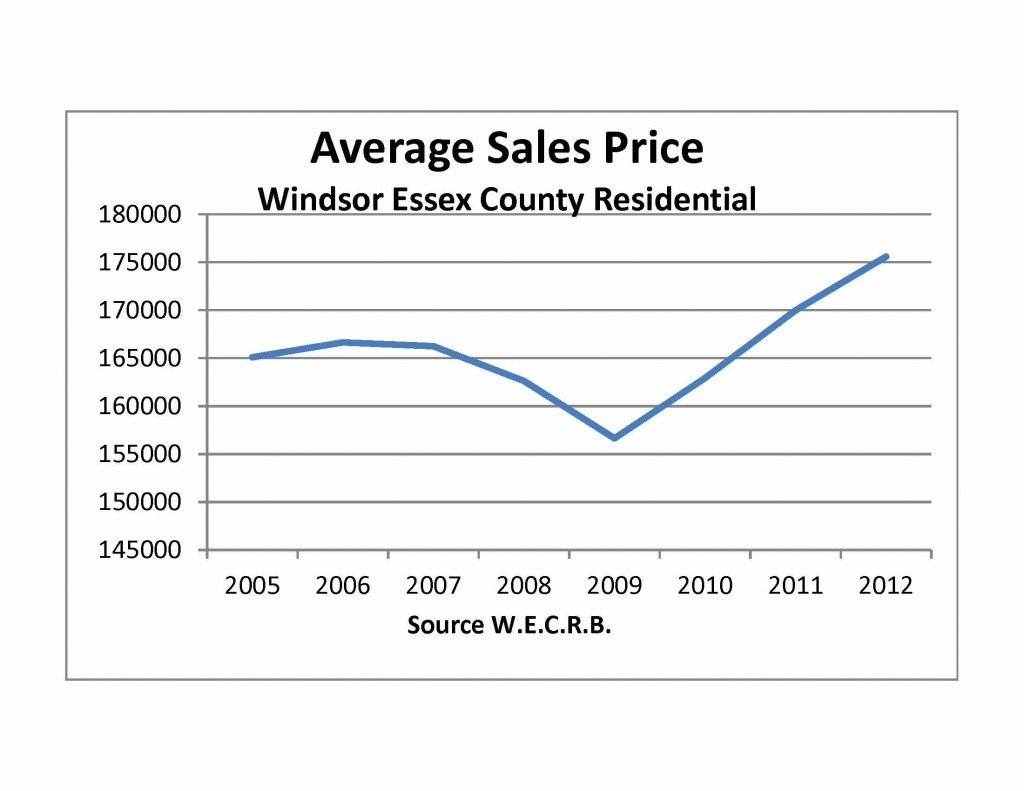

The number of residential sales in Windsor and Essex County increased 16% in January 2013, compared to January 2012. Despite the increase in sales the average price decreased to $166,417 from $168,764 in January 2012. It should be noted that the average price was more a factor of certain county areas experiencing several less expensive sales than the prior year. When we Look at the Windsor area only, the average home price increased slightly. The January 2013 sales to listings ratio (listings sold expressed as a percent of listings received) was 45% which is up from 38% in 2012. As inventory shrinks and sales remain steady or grow, we are anticipating prices to rise.

CONDO MARKET

During the one month period ending January 31, 2013 there were 31 condominium sales in the market place. This compares to 28 condo sales in the same period of 2011 As of January 31, 2012 there were 67 condo listings received. This was the same amount of listings received in January 2012. The sales to list ratio (Listings sold expressed as a percent of Listings received) for January 31, 2013 period was 46%. In 2012 it was 42%. The inventory of active condo listings as of January 31, 2013 was 202 units. This compares to 224 units in 2012 and is a decrease of 9.8%. The number of months of inventory represents the number of months it would take to sell current inventories at the current rate of sales activity, and is a further measure of the balance between housing supply and demand. It currently stands at 6.5 months. In 2012 it was 6 months. The average condo selling price was $149,625 in January 2013 an increase of 24.5% from 2012. While we do feel there is upward price pressure on Condos, a 24% increase is more a factor of several more expensive units selling in January, than an indication of the market as a whole. The average listing during the period took 65 days to sell. Compared to 108 in 2012 and sold for 97% of the list price.

by admin | Jan 24, 2013 | Market Watch, Recent Works

RESIDENTIAL

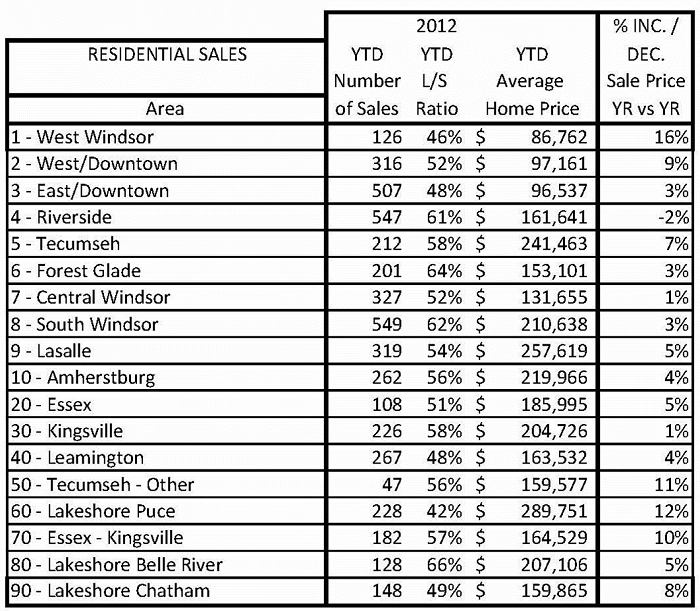

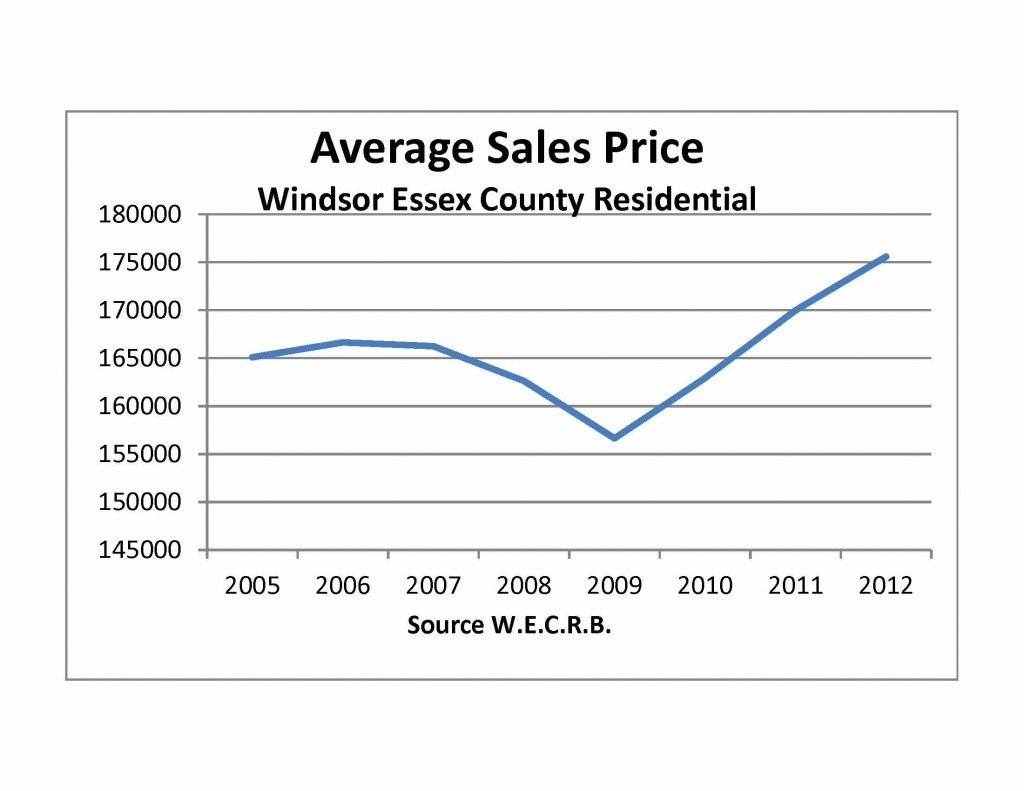

During the twelve month period ending December 31, 2012 there were 4,933 residential sales in the market place this compares to 4,786 residential sales for the same period in 2011, an increase of 3%.

As of December 31, 2012 there were 9,061 residential listings received this compares to 9,364 in the same period for 2011, this is a decrease of 3% in residential listings received.

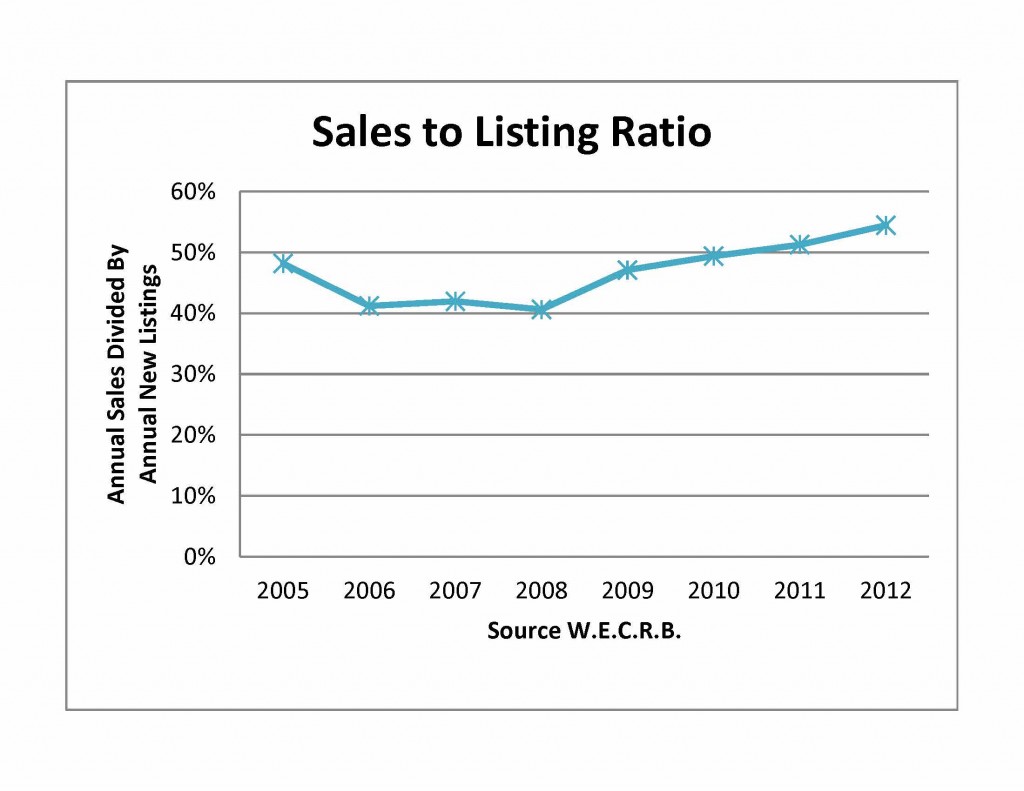

The sales to listings ratio (listings sold expressed as a percent of listings received) for the period was 54% in 2011 it was 51%.

The inventory of the active residential listings as of December 31, 2012 was 2,192, this compares to 2,450 in 2011. This is a decrease of 11% in active residential listings.

The number of months of inventory represents the number of months it would take to sell current inventories at the current rate of sales activity, and is a further measure of the balance between housing supply and demand. It currently stands at 5.3 months. In December 2011 it was 6.1 months.

The average residential selling price was $175,515 for the 12 month period ending December 31, 2012. This is an increase of 3% from 2011.

The average listing during the period took 74 days to sell (76 in 2011) and sold for 95% of the list price.

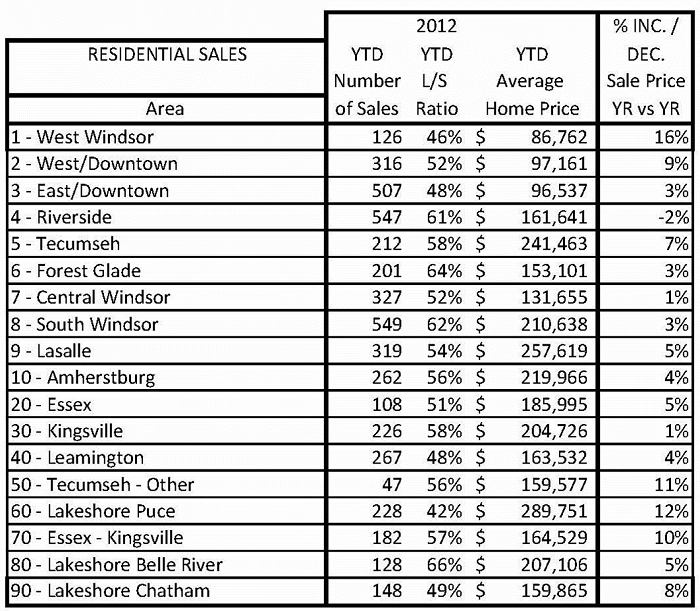

In the Market Watch for December 2012, we broke down changes in average residential sale price by area, while the overall average sale price increase is 3% in Windsor and Essex County, several areas performed better in 2012.

CONDO

During the twelve month period ending December 31, 2012 there were 442 condominium sales in the market place. This compares to 425 condo sales in the same period of 2011, an increase of 4%.

As of December 31, 2012 there were 809 condo listings received. This compares to 878 for the same period of 2011, a decrease of 8%.

The sales to list ratio (Listings sold expressed as a percent of Listings received) for the December 31, 2012 period was 55%. In 2011 it was 48%.

The inventory of active condo listings as of December 31, 2012 was 206 units. This compares to 227 units in 2011 and is a decrease of 9%.

The number of months of inventory represents the number of months it would take to sell current inventories at the current rate of sales activity, and is a further measure of the balance between housing supply and demand. It currently stands at 5.6 months. In 2011 it was 6.4 months.

The average condo selling price was $126,745 for the 12 month period an increase of 4% from 2011.

The average listing during the period took 83 days to sell. Compared to 101 in 2011 and sold for 96% of the list price.

by admin | Dec 15, 2012 | Market Watch, Recent Works

Residential Sales: Residential sales in November 2012 increased 13.09% compared to November 2011. Year to date sales are up 3.93%. The Listing Sale Ratio Year to date was 54% which indicates we are in a balanced market moving towards a Sellers Market. Listings as a whole are down 3.10% year to date from the previous year. With low inventories and steady demand we are expecting prices to rise. The Average Sale Price Year to Date was $175,287 compared to $170,105 YTD in 2011.

Condominium Sales: The condo market has significantly improved and now has a listing sales ratio of 55% year to date. Average Sale Price year to date was $127,105 in 2012 compared to $119,485 YTD in November 2011.

This month we have broken down Average home price by area from WECAR Statistics. This breakdown gives you an idea of how each area is performing this year compared to last year.